Full company name

Advance Capital Partners, upravljanje alternativnih investicijskih skladov, d.d.

Short company name

Advance Capital Partners d.d.

Business address

Dalmatinova ulica 8, 1000 Ljubljana, Slovenija

Tax number

SI 63283069

Registration number

9430598000

Share capital

650.000 €

Bank account

SI56 0292 3026 4900 641

SWIFT

LJBASI2X

Management board

Aleš Škerlak, CEO

Tim Umberger, Board Member

Matej Runjak, Board Member

Supervisory board:

Darko Martin Klarič, President of the Supervisory Board

Luka Brezovec, Member of the Supervisory Board

Marko Vavpetič, Member of the Supervisory Board

ADVANCE CAPITAL PARTNERS

WE CONSOLIDATE INDUSTRIES. WE DIGITALIZE. WE BUILD REGIONAL CHAMPIONS!

Advance Capital Partners is the leading private equity fund manager in the Adriatic region, combining decades of experience, recognized expertise, and a strong track record of transforming companies into regional champions. Managing over EUR 250 million in assets and working with more than 100 investors, we are building a foundation for future growth.

Our experienced team has an exceptional track record, having successfully carried out more than 30 complex mergers and acquisitions in the most demanding market conditions. We continuously seek growth opportunities, define a clear strategy for each company, and take an active ownership approach. We work with top professionals who form strong management teams, developing companies in partnership with existing owners and management.

OUR INVESTMENT PHILOSOPHY

We believe in the power of long-term partnerships built on mutual trust and shared goals. Through strategic leadership, financial support, and exceptional market access, we help our companies realize their full potential.

- Local presence, global mindset: We respect the local roots of our companies and help them grow by applying the best global business practices.

- Partnership: We strive to create lasting relationships where all stakeholders feel aligned. We build partnerships with existing owners and/or management teams.

- Scaling up: We acquire companies we can help grow through business model optimization and add-on acquisitions to achieve scale.

- Active ownership: The best way to create value is through close cooperation on strategic, financial, and M&A activities, as well as corporate governance.

- Reputation: Our mission is to continue strengthening our reputation as the preferred partner for companies and management teams that share our values.

HOW OUR STORY BEGAN

Our journey started in 2015, with the establishment of Adventura Investments. Over the years, Adventura Investments developed four strong investment pillars: mobility (Nomago), specialized retail/e-commerce (Big Bang), tourism (Sixt Croatia, Sixt Slovenia, Nautical center Liburnia), and IT (Margis). In record time, Adventura Investments became one of the most successful Slovenian business groups, reaching EUR 450 million in consolidated revenues and EUR 45 million in annual EBITDA, with more than 2,000 employees at its peak.

As the number of private and institutional investors interested in deeper collaboration grew, in 2023 the decision was made to establish a professional private equity fund manager. The investment team simultaneously transitioned from Adventura Investments to Advance Capital Partners, ensuring full continuity of knowledge, experience, and investment philosophy. Advance Capital Partners today continues and upgrades the mission of Adventura Investments, while upholding the highest professional standards. Advance Capital Partners manages investments in Big Bang and Margis, while Adventura Investments remains a private investment group and a key investor in both private equity funds – Advance Capital Partners SIS and Advance Capital Partners AIS II.

OUR JOURNEY

- July 2023: Advance Capital Partners is established.

- July 2023: Advance Capital Partners establishes the ACP AIS II fund.

- August 2023: Advance Capital Partners establishes the ACP SIS fund.

- November 2023: The ACP SIS fund assumes management of majority equity stake in Margis.

- April 2024: Advance Capital Partners completes its first fundraising round, securing EUR 170.6 million in commitments for the ACP SIS and ACP AIS II funds.

- April 2024: ACP SIS acquires an 80% stake in A2U, a leading Slovenian specialized cycling and e-bikes retailer.

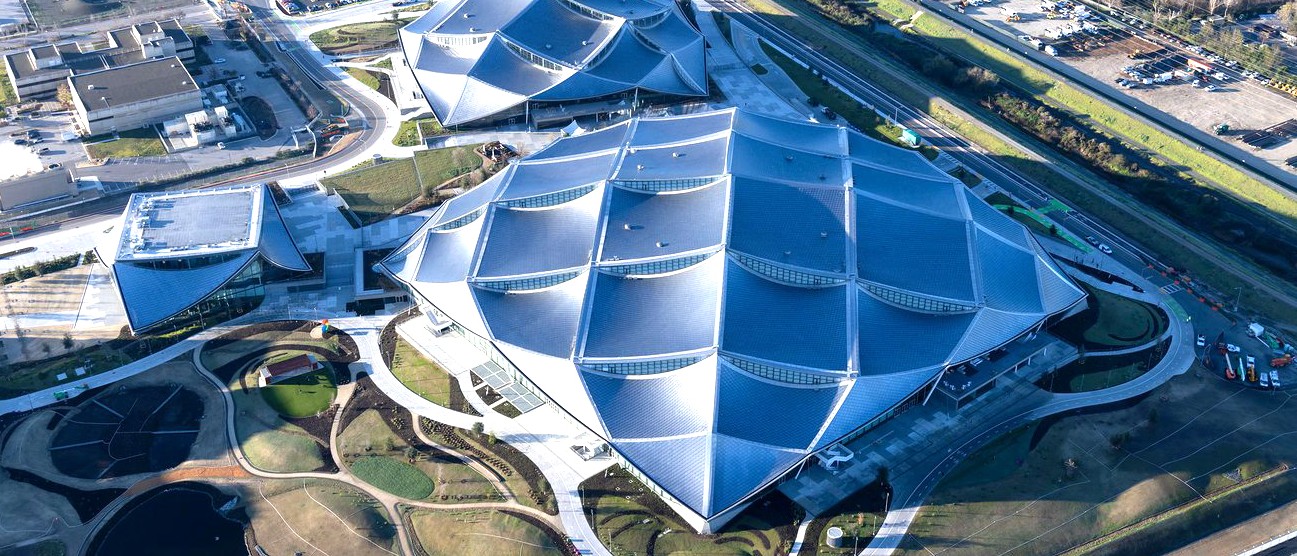

- June 2024: ACP SIS acquires 60% equity stake in the Croatian solar company Solvis.

- July 2024: Advance Capital Partners completes its second fundraising round, raising total investor commitments for ACP SIS to EUR 170 million.

- July 2024: ACP AIS II assumes management of the investment in Big Bang and Big Partner.

- October 2024: Advance Capital Partners completes its third fundraising round, raising total investor commitments for ACP SIS to EUR 198 million.

- November 2024: ACP SIS establishes Aeon Digital Group, the IT platform for sector consolidation, that also assumes management of investment in Margis.

- February 2025: ACP SIS increases ownership in A2U to 85%.

- May 2025: ACP SIS completes the acquisition of 100% equity stake in Unitur.

- September 2025: ACP SIS signs an SPA to acquire Mikrocop, a successful Slovenian IT company.

- October 2025: ACP SIS completes the acquisition of 60% equity stake in Mass Group.

- October 2025: ACS SIS signs an SPA to acquire 100% equity stake in Leder & Schuh.

*Advance Capital Partners d.d. is a registered manager of alternative investment funds. Advance Capital Partners has obtained a license from Securities Market Agency for the management of alternative investment funds in accordance with the provisions of the ZUAIS and AIFM Directive.

Back

Back